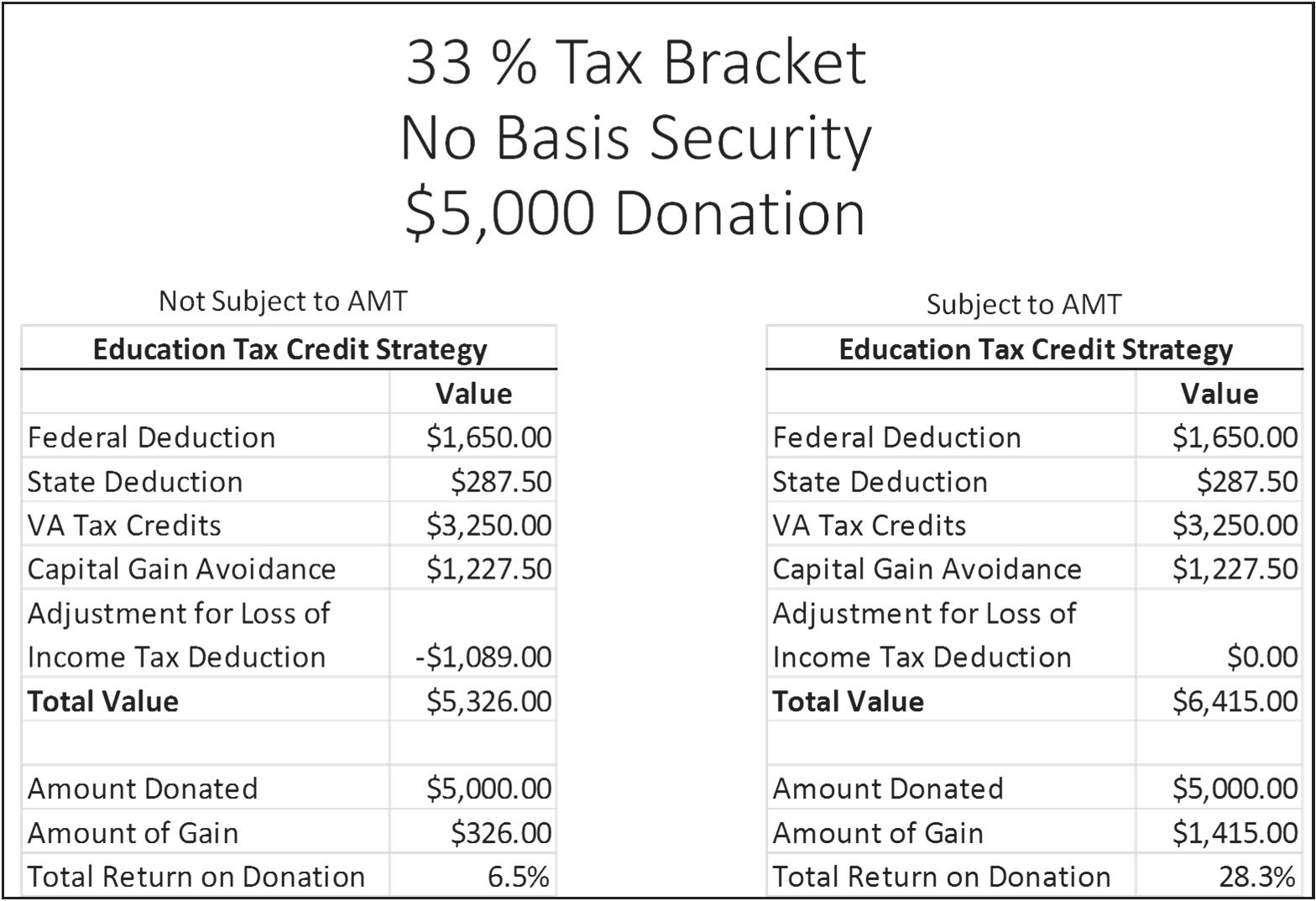

One hundred and twenty-five Roanoke Catholic students receive tuition assistance under the state’s Education Improvement Scholarships Tax Credits program. Meanwhile, our EISTC donors are cutting, if not eliminating, their state income tax bills … and in many cases are making money.

“When I first learned that contributions to the EISTC program were both tax deductible (at federal and state levels) and came with a 65 percent Virginia state income tax credit, I thought it was simply too good to be true,” says Scott Sexton, a partner at Gentry Locke Attorneys, whose grandson attends RCS (pictured above). “Accounting and legal experts soon confirmed for me that it was legitimate. I hate to think of all the years that we paid funds directly as Virginia income taxes when we could have been getting so much more value out of the same dollars.”

Virginia enacted EISTC in 2013 to provide tuition assistance for families wishing to move their children out of public schools. The tuition assistance is funded from charitable contributions by private donors made, in RCS’ case, to the Catholic Diocese of Richmond’s McMahon Parater Foundation.

Given the tax benefits to donors, growth in the EISTC program has been exponential. In FY2014, RCS raised $73,000. In FY2017, the school raised $716,287, and so far this year, $622,019.

Total giving to RCS to date: $2,100,026.

Individuals may donate between $500 and $125,000 (no maximum for businesses.) Donors can use the tax credits starting the year of the donation, and for up to five successive years.

“And the State benefits as well,” adds Sexton. “The benefited students are removed from the responsibility of the tax-funded public schools and receive a superior education at a fraction of the cost. It is a win-win-win for all parties — and it allows donors like us to make the most out of our charitable donations.”

CLICK HERE for more information or contact:

Debbie Stump

Director of Education Tax Credits

[email protected] | 540.982.3532