A smart investment for Roanoke Catholic … and you!

Your investment in Catholic education today provides scholarship funds for tomorrow’s students.

Virginia’s Education Improvement Scholarships Tax Credits (EISTC) Program provides a 65% return of your donation in Virginia state tax credits.

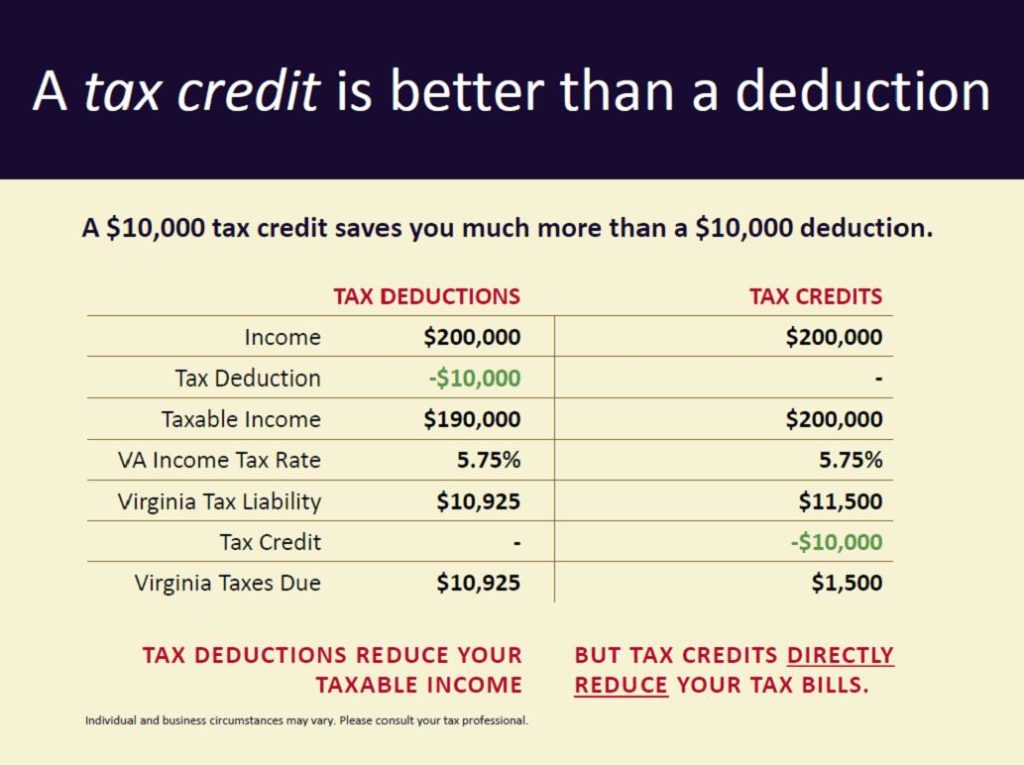

What’s great about tax credits?

- They directly reduce your tax bill.

- Individual donations starting at $500 are eligible.

- All business donations are eligible.

- If you choose to itemize, you will also receive federal and additional Virginia state tax reductions for charitable organizations.

- When you donate appreciated stock, you also eliminate capital gains tax.

Get started to receive your tax credit this year!

CLICK HERE FOR TAX CREDITS FACT SHEET

For more information, contact Geralynn Trellue, Dean of Advancement, at 540.982.3532

How the Program Works:

Under EISTC, contributions to state-approved foundations qualify for standard federal and state tax deductions plus Virginia Tax Credits equal to 65% of the donation. In other words, you automatically shave $650 off your Virginia tax bill with a $1,000 contribution, not to mention enjoying your other federal and state deductions.

Donors can use the state Tax Credits beginning the year that the donation is made, and for up to five successive years.

CLICK HERE FOR TAX CREDITS PRESENTATION

Get started by downloading these two documents and mailing to the Diocese of Richmond: